Abstract

Community-level vulnerability to pyramid scheme fraud may be affected by place-based sources of strain and opportunity. Using national victim data from a pyramid scheme fraud case from 2000–2013, this research explores pyramid scheme adoption with group-based trajectory modeling (GBTM). GBTM is used to look for distinct trajectories of pyramid scheme join rates and to explore the effect of strain, as measured by a county’s Social Vulnerability Index and unemployment rate, and opportunity or protection, as measured by a series of social capital variables, on the group trajectories. Findings suggest that county-level strain, including the county’s Social Vulnerability Index and unemployment rate are related to pyramid scheme victimization, especially early adoption. We also find that social capital variables – which can, in theory, reduce strain or increase opportunity – have a nuanced relationship with fraud victimization. While our findings are drawn from a single pyramid scheme, they point to the potential to analyze case data to inform preventative and monitoring strategies appropriate to local-level characteristics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Historically, white-collar crime has taken a secondary role to street crimes within criminology (Simpson and Weisburd 2009; Weisburd et al. 2001). Research suggests that the damage and cost of white-collar crime is even greater than that of street crime (e.g., Cohen 2016; Croall 2016). Estimating the economic cost of financial victimization can be difficult. Anderson (2019) estimated that, in 2017, 40 million U.S. adult consumers were victims of one or more of the fraud types included in the Federal Trade Commission (FTC) survey, with an estimated 61.8 million incidents of fraud and a median loss of $100 per incident in that year. The survey found that fraud victims were more likely than non-victims to have experienced a negative life event in the prior two years and were more likely to self-report that they had more debt than they could handle financially (Anderson 2019). Using consumer complaint data, the Federal Trade Commission (FTC) estimated that consumers have lost $610 million to income scams since 2016 and that losses have increased during the pandemic (Fair 2020). Focusing on pyramid schemes, the fraud of interest for this research, the FTC estimated that, in 2017, there were approximately 800,000 victims of pyramid schemes (Anderson 2019).Footnote 1 More recently, consumer complaints related to pyramid schemes and multi-level marketing companies rose by 459% between 2019 and 2021 (Federeal Trade Commission, 2022).

Victims often pay to join a pyramid scheme and pay for ongoing participation, resulting in large variations of investment between victims. Button et al. (2009) suggests that pyramid schemes are the largest scam in terms of costs to society compared to gambling scams, bogus products and services, technological scams and others. In addition to the direct costs of the fraud, there are also secondary financial impacts. Victims may need to work longer hours and they may lose their home, their ability to pay for retirement, and their ability to support children and grandchildren (Spalek 2007). Secondary psychological impacts include stress, anxiety, depression (Button et al. 2009; Ganzini et al. 1990), and self-blame and embarrassment or stigma (Shichor et al. 2000; Shover et al. 1994; Titus and Gover 2001). Pyramid schemes also have lasting effects on relationships and communities, particularly historically marginalized communities, as those involved in pyramid schemes are often recruited by others that they know (Fairfax 2001). The impacts of white-collar crime victimization highlight the importance of focusing research in this area with the specific goal of increasing and improving prevention efforts.

Criminological theory can provide a useful framework when developing effective prevention models, but research focused on applying theory to white-collar crime victimization is lacking (Croall 2016). Examples of criminological theories that have been applied to victimization include routine activities theory and life styles theory (e.g., Cass 2007; Fisher et al. 2009) and self-control theory (e.g., Schreck 1999; Stewart et al. 2004), but, to date, there is limited research on white-collar crime victimization and even less that focuses on applying theory to white-collar crime victimization (for exceptions see Holtfreter et al. 2008; Policastro and Payne 2015).

The goal of the current study is to address limitations in the literature by using differential opportunity theory as a framework to explore risk factors for pyramid scheme victimization within communities. Specifically, we add to previous literature by using a group-based trajectory model to determine whether there are trajectories of county level pyramid scheme join rates and to explore whether social capital acts as protection or opportunity for joining a pyramid scheme. Group-based trajectory modeling is well-suited for a place-based analysis, potentially revealing those factors that provide “fertile soil” for the proliferation of pyramid scheme activity. Our findings provide a new perspective on pyramid scheme victimization leading to new focused prevention ideas and opportunities for future research. We begin by describing pyramid schemes before moving into a discussion of the theoretical framework and previous white-collar crime literature.

Pyramid scheme defined

A pyramid scheme is any compensation structure designed to create a recruitment chain, where this chain dooms the majority of participants to financial loss (Gastwirth 1977). New entrants must pay to participate and recruit others in order to cover their own personal investment and have an opportunity to gain from the structure. The scheme’s promotion involves inherent deception as it prompts “action based on a suggested market opportunity that does not truly exist or that is not accurately portrayed” (Vander Nat and Keep 2002, p. 139) and is designed to deliver gains to a small fraction of participants, where those gains are funded by losses of the majority. While there is no federal pyramid scheme law in the United States, pyramid schemes are litigated at the federal level as a deceptive and unfair practice, often under Sect. 5 of the FTC Act. Cases are also initiated by individual states, as was the case for the pyramid scheme of interest in this study when the firm was sued by individual states before the FTC joined with additional states to initiate nationwide legal action. Additionally, pyramid scheme cases have been initiated by the Securities and Exchange Commission and are litigated as private class action cases. Typically, pyramid scheme offenders (i.e., founders and, sometimes, top promoters) face financial penalties, bans from prohibited practices, and other injunctive terms. On rare occasions, promoters face criminal prosecution.Footnote 2

While pyramid schemes were originally promoted with literal chain letters, they are now propagated through social media channels and in person, typically within existing social networks. Pyramid schemes can come in many forms. Some pyramid schemes take the form of gifting circles where the victim pays money or other in-kind contributions into the scheme, and are then instructed and incentivized to recruit others who will do the same. Examples include the Blessing Loom (Gressin 2020) and Secret Sister Exchange (Better Business Bureau 2021) promoted on Facebook, Instagram, and other social media platforms. When pyramid schemes are crafted as gifting circles, there is no product or service on offer.

Pyramid schemes can also be promoted as multi-level marketing (MLM) business opportunities. Participants in an MLM-based pyramid scheme pay to join, typically continue paying to maintain the opportunity for rewards, and recruit others to do the same. Rather than simply paying cash into the system, as in a gifting circle like the Blessing Loom, the participant in an MLM-based pyramid scheme is paying for products or services in an effort to advance in, what they believe to be, a legitimate business opportunity and recruiting others who will do the same. If participant compensation in an MLM is fueled by the recruitment of new participants (“sellers”) rather than by the genuine demand for the MLM firm’s products or services, it can function as a fraudulent scheme that leaves the majority of participants with losses, by design (Bosley and Knorr 2018; Keep and Vander Nat 2014; Vander Nat and Keep 2002). Specifically, courts in the U.S. have used the Koscot test (1975) to distinguish between legal MLM programs and pyramid schemes. The Koscot test states that a pyramid scheme, organized and promoted as an MLM, is:

“characterized by the payment by participants of money to the company in return for which they receive (1) the right to sell a product and (2) the right to receive in return for recruiting other participants into the program rewards which are unrelated to sale of the product to ultimate users. In general such recruitment is facilitated by promising all participants the same ‘lucrative’ rights to recruit.” (Emphasis in original.)

The Koscot test has been applied on a case-by case basis within federal litigation.Footnote 3

Just as in many other consumer fraud schemes, the individual participant often lacks the knowledge or information to identify the MLM-based pyramid scheme as fraudulent, as the scheme purposely masquerades as a legitimate business opportunity. Participants of such schemes have been broadly defined as victims within litigation contexts, even if the incentives and rules of the scheme have prompted them to recruit others. As stated in a 2016 federal court opinion regarding class certification, “it is reasonable to infer that individuals do not knowingly join pyramid schemes” as “pyramid schemes are inherently deceptive and operate only by concealing their fraudulent nature” (Torres v. SGE Management 2016). Experimental research has found that consumers have difficulty identifying even the most explicit pyramid schemes as fraud (Bosley et al. 2019).

Given that pyramid scheme participants receive an explicit reward for recruitment and, in fact, cannot generally recoup their own investment without engaging in such recruitment activities, participants ultimately promote the scheme to others, often those in their existing social networks. Perri and Brody (2012) found that scheme promoters often adapt promotional language to appeal to the group’s interests, needs, and values and capitalize on the group’s existing infrastructure (e.g., mailing lists, connections between parishes, bible study groups, community centers). Individual cases provide examples of targeted groups. For example, TelexFree was charged with operating a MLM-based pyramid scheme that targeted Brazilian and Dominican immigrants in the Boston area (Sacchetti and Healy 2014). Multiple cases, including that of Fortune Hi-Tech Marketing (FHTM)—the subject of this paper—have implicated religious leaders in promoting a fraudulent scheme to their own congregants (Austin 2004; Gunn 2015; Perri and Brody 2012; O’Donnell 2010). FHTM also allegedly targeted Spanish-speaking and immigrant communities (FTC 2014).

When scheme promoters tailor promotion to particular networks and scheme participants are incentivized to recruit members from within their own communities, the consequences of pyramid scheme fraud goes beyond individual financial losses to extend to families, affinity groups, and communities tapped for recruitment (Austin 2004; Fairfax 2001; Frankel 2012). While victims actively promote the scheme to others, for most, involvement and recruitment are best understood as actions in pursuit of personal financial goals, rather than as a conscious act to victimize or ensnare others in the scheme (Frankel 2012).

In order to understand pyramid scheme victimization, this research explores participant data obtained for a nationwide pyramid scheme—Fortune Hi-Tech Marketing (FHTM)—which operated from 2000 to 2013 before being sued by the Federal Trade Commission and multiple states. FHTM was founded by Thomas Mills and Paul Orbeson, who both promoted a different MLM company (Excel Communications) prior to launching FHTM together. FHTM marketed itself as a MLM business opportunity and recruits were told they could earn money from selling the company’s products and services to customers and by recruiting additional FHTM distributors. FHTM offered a proprietary line of skincare products and acted as a third-party vendor for existing products such as Dish Network and Roadside Auto Club. To join FHTM, an individual would sign a distributor agreement and pay an enrollment fee, typically about $300. To qualify for commissions and bonuses, participants had to pay $130 to $400 per month to remain eligible for compensation (FTC 2013).

FHTM was sued by the State of Montana in 2010, and the suit was apparently triggered by consumer complaints in the state (O’Donnell 2010). Interestingly, the state’s Commissioner of Securities, who led the case against the company, was pitched FHTM by her brother and the Commissioner learned that other family members had already joined FHTM by the time she realized that her office was investigating the company (O’Donnell 2010). Montana ultimately settled with the company, and the settlement provided partial refunds to consumers and forced changes to some business practices, but allowed FHTM to continue conducting business in the state. Additional states, including Texas and North Dakota, investigated the company after Montana’s action but the company effectively ceased all operations after it was sued by the FTC and the attorneys general from Kentucky, North Carolina, and Illinois. A judge granted a temporary restraining order in 2013 and placed the company in receivership.

While FHTM represented itself as a legitimate MLM business opportunity, Kentucky Attorney General Conway called FHTM “a classic pyramid scheme in every sense of the word” and the complaint, filed by the FTC and multiple states including Kentucky, alleged that the firm “provided much larger rewards for recruiting people than for selling products, and more than 85 percent of the money consumers made was for recruitment” (FTC 2013). The court-appointed receiver found that more than 98 percent of participants paid in more money to the scheme than they received back from FHTM, leaving them with a net loss, and at least 94 percent ended their participation within one year of joining the scheme (FTC 2014). A judgment of $169 million was levied against the firm. Both Orbeson and Mills were ultimately banned from multi-level marketing and forfeited at least $7.75 million in assets as part of the settlement terms, and the company never resumed operations (FTC 2014). The FTC ultimately sent $3.7 million back to FHTM victims in the form of redress payments (FTC 2016).

The data we use was obtained from the court-appointed receiver in this case. As will be discussed in a subsequent section, our data is unique in that it represents the full population of FHTM participants in the United States, including their join date and location. Other personal identifying information was redacted. As these data do not allow us to identify the small share who may have profited from the scheme, the courts have deemed that participants are generally deceived into participation, and the share of participants who profited is expected to be relatively small, we proceed to analyze the population of participants as victims of white-collar crime. Next, we turn to explaining the relationship between theory and pyramid scheme victimization.

Strain theory and victimization

There is abundant research that applies traditional criminological theories to victimization; for example, routine activities theory and sexual victimization (Cass 2007); social learning theory and stalking victimization (Fox et al. 2011); and self control and online victimization (Pratt et al. 2014). While there is research that explores the connection between strain and victimization (e.g., Curry and Zavala 2020; Walters 2020), there is none that explores strain and pyramid scheme victimization, and only limited research that explores white-collar crime victimization more broadly (e.g., Ganzini et al. 1990; Shichor et al. 2000; Shover et al. 1994). Due to the limited literature that explores strain and victimization, this section will focus on literature that discusses strain and criminal offending. We argue that the same propositions that are used to explain criminal offending in strain theory can also be used to explain victimization. We are not arguing that joining a pyramid scheme is criminal behavior, but instead that strain theory can be applied to pyramid scheme victimization.

Theoretical framework: strain and opportunity

This paper relies on Cloward and Ohlin (1960)’s differential opportunity theory to frame the discussion of county level trajectories of pyramid scheme victimization. Cloward and Ohlin (1960) define strain as a gap between aspirations and expectations, specifically suggesting that there may be gaps in social advancements and money. This concept of strain is often conceptualized as a failure to reach the “American Dream”. (Cullen and Messner 2007). Cloward and Ohlin take the concept of strain further than previous strain theorists and suggest that, in order for strain to result in delinquency, there must also be opportunity for delinquency and that all opportunities to commit crime are not equal; a person’s particular opportunities and communities or contextual factors will interact with the strain that they feel and affect the type of crime they commit. We suggest that this same mechanism is true for victimization: a person’s particular opportunities and communities will interact with the strain that they feel and affect the type of victimization they experience. Specifically, when a person feels strain, they may join a subculture in an attempt to lessen the strain and the particular subculture(s) available to them will determine the type of victimization experienced. In this research, the “subculture” available to them is a pyramid scheme; it is the involvement in the pyramid scheme subculture that makes a person vulnerable to victimization. A pyramid scheme has its own sets of norms and values around the benefits of the opportunity (e.g., “financial freedom,” “time freedom,” autonomy), the expectations of the participants (e.g., recruitment, sales, participation in conferences and events), and the role that the pyramid scheme plays in a person’s life (e.g., many pyramid schemes discuss those involved as a “family”). Differential opportunity theory suggests that if a person experiences strain within a place or social network that does not already have pyramid scheme activity, they are less likely to become involved in a pyramid scheme.

Differential opportunity is especially relevant for pyramid schemes which are spread through pre-existing social networks, particularly religious institutions and other affinity groups such as professional organizations, ethnic or racial groups, age cohorts, or familial networks (Bosley and Knorr 2018; Fairfax 2001; Perri and Brody 2012). These pre-existing social networks may already be behaving as subcultures with their own norms and values that make them particularly susceptible to pyramid scheme spread, as pyramid schemes have adapted recruitment to appeal to the cultural norms of the existing subcultures. For example, FHTM spread through religious networks by using the language of Christianity. One top FHTM recruiter, a Pentacostal preacher, promoted FHTM saying: "The Scripture says without a vision, people perish” and that FHTM is “a ministry that can produce whatever it is that you need" (O’Donnell 2010).

In Cloward and Ohlin’s (1960) framework, the pyramid scheme network or affinity networks could be seen as a particular type of subculture available to a person feeling financial strain. The pre-existing network or subculture and pyramid subculture may interact to play two unique roles 1) participants are recruited through subculture or affinity networks and 2) the pyramid scheme is a subculture of its own that participants may join to ameliorate strain. An alternative explanation is that social networks that could serve as conduits of opportunity may instead be protective from involvement in pyramid schemes. Putnam (1993) suggests that these networks and institutions may result in social capital or “networks, norms, and trust that facilitate action and cooperation for mutual benefit” (p. 35). While there has been little research in this area on pyramid schemes, social capital has been found to be protective for other types of victimization like school victimization (Gottfredson and DiPietro 2011) and violent victimization (McCarthy et al. 2002). While social capital may provide protection for pyramid scheme victimization, it may be that pyramid scheme victimization relies on social capital to spread victimization. Previous literature suggests that social capital may in fact be “pro-social capital” or “anti-social capital” (Hucklesby 2008; Kay 2020). For example, for pyramid scheme victimization, religious institutions may protect from pyramid scheme victimization by providing social support during economic downturns (Johnson et al. 2000), but they may also increase opportunity by fostering relationships, information flow, and in-group trust (Bosley and Knorr 2018). Previous literature has found that social connections may in fact lead to an increase in financial fraud by exploring the effect of social ties on Ponzi scheme victimization (Nash et al. 2018). While Ponzi schemes are not the same as pyramid schemes,Footnote 4 they do spread in similar ways and may illustrate the effect that social connections and networks have on increasing financial fraud.

This research will explore whether social capital acts as an opportunity for pyramid schemes or whether these networks act as more traditional protective factors at the county level.

Strain and opportunity applied to white-collar crime victimization

Strain theories have been applied to white-collar crime and corporate crime in general (e.g., Langton and Piquero 2007; Shover et al. 2004; Wang and Holtfreter 2012), but not to pyramid schemes. There also is no literature that we are aware of that applies Cloward and Ohlin’s (1960) version of strain theory to white-collar crime offending or victimization or that applies any version of strain to white-collar crime victimization. For this reason, this section will review literature that has connected different versions of strain theory with white-collar crime including general strain theory and institutional anomie theory. While these two theories are not the theory of interest for this paper, this literature provides evidence that strain affects white-collar crime at both the individual and macro level. This research study adds to the existing literature by incorporating opportunity and protection, thus expanding on previous literature by applying Cloward and Ohlin’s differential opportunity theory.

Even with limited directly relevant literature, it is important to explore how different versions of strain theory have been applied to white-collar crime. Criminal offending theories provide insight to how they might be applied to victimization and suggest motivations for financial crime involvement. In general, literature has found some support for the connection between strain theory and white-collar crime. Shover and colleagues (Shover et al. 2004) conducted interviews and found that fraudulent telemarketers focused on the economic gains of their activities. Although telemarketers may participate because of economic gain, Shover and colleagues (Shover et al. 2004) suggest that they participate, in part, because they think that it takes less work than traditional means to economic success. Like much of the strain and white-collar crime research, Shover and colleagues (Shover et al. 2004) suggest that financial strain is not just limited to those with lower income, but is distributed across different income levels.

Langton and Piquero (2007) explored a test of general strain theory with a variety of types of white-collar crime. Among other things, they found that for white-collar crimes of false claims, strain was positively related to offending. This was not true for all types of crime, but did suggest that there is a connection between strain and fraudulent white-collar crimes.

Two studies focus on institutional anomie theory, a more recent macro version of strain theory. Although different from differential opportunity, institutional anomie theorizes that a macro focus on the economy to the detriment of other social institutions such as education, religion, and polity leads to increases in offending (Messner and Rosenfeld 1994). This literature is relevant to our study by suggesting that a macro level economy may lead to white-collar criminal offending, just as our research explores the effect of inability to reach economic success through county-level unemployment on pyramid scheme victimization. Schoepfer and Piquero (2006) found evidence for institutional anomie theory through the effect of voter participation and an interaction between polity and the economy: as voter participation increased, embezzlement decreased, and increased polity decreased the effect of the economy on crime. It is also important to note that a weaker economy led to a decrease in embezzlement. The authors suggest that this is because embezzlement is the type of crime that requires a job.

Perhaps most relevant, Trahan et al. (2005) applied institutional anomie theory to explore the effect of strain on involvement in a Ponzi scheme through a case study. In addition to applying a macro-level strain theory to a similar type of financial fraud, Trahan and colleagues also added the discussion of opportunity to institutional anime theory (just as differential opportunity theory discusses the importance of opportunity). While Ponzi schemes and pyramid schemes are different types of fraud, they may have similar impetus for getting involved, i.e., financial gain. Trahan et al. (2005) posit that opportunities matter by suggesting there would be no victimization with no Ponzi scheme; without a Ponzi scheme, the victims may have done something else to reach the American Dream. Trahan and colleagues suggest that the American Dream is combined with the opportunity that is presented by the Ponzi scheme. Similarly, in differential opportunity theory, Cloward and Ohlin (1960) suggest that it is the focus on the American Dream (monetary success) and the inability to reach the American Dream (strain) that combine with differential opportunities to provide certain types of offending or victimization. Cloward and Ohlin would suggest that in Trahan and colleagues’ research, the ponzi scheme is the opportunity or subculture available to reach the American Dream. In our research, we suggest that the pyramid scheme is the subculture to reach the American Dream and individuals are victimized by the pyramid scheme.

In sum, despite a dearth in literature that connects pyramid scheme victimization and differential opportunity theory, there is prior literature that suggests that there is a connection between white-collar crime and strain theory more broadly and specifically, this literature finds support for a connection between the inability to reach the American Dream and opportunity and Ponzi schemes, a similar type of fraud to pyramid schemes.

The current study

This research will add to the literature in the following ways: 1) apply differential opportunity theory at a macro level to pyramid scheme victimization 2) explore social capital as opportunity or protective factors, 3) use group-based trajectory modeling to explore county-level trajectories of pyramid scheme victimization, and 4) inform policies that will provide intervention points for communities with a likelihood of high join rates of pyramid schemes in order to prevent large losses in communities.

The current study proposes to answer the following research questions using a group-based trajectory model:

-

RQ1: Are there distinct trajectories of pyramid scheme adoption among groups of counties?

-

RQ2: Does strain increase the likelihood of pyramid scheme adoption within trajectory groups?

-

RQ3: Does social capital act as opportunity or protection for pyramid scheme proliferation?

Methods

Data source and measures

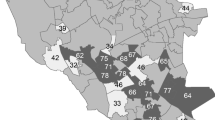

This paper uses Fortune Hi-Tech Marketing (FHTM) participant data made available from the company’s 2014 settlement with the Federal Trade Commission (FTC). As described in Bosley and Knorr (2018), the FTC and multiple states alleged that FHTM operated as a pyramid scheme, masquerading as a legal MLM, and misrepresented the opportunity to consumers. Headquartered in Kentucky, FHTM and its participants ultimately recruited over half a million individuals in the U.S. between 2000 and 2013, with participants in approximately 96 percent of U.S. counties. Figure 1 depicts the spread of FHTM throughout the country over time.

The final dataset includes 521,246 individuals who joined FHTM between 2000 and 2013. While name and other identifying information was redacted, the dataset includes address information and the join date (i.e., the day the individual paid the onboarding fee and signed the distributer agreement, officially becoming an FHTM member) for each participant. Participant information was aggregated to create quarterly data for each county, based on address ZIP code using a 2010 U.S. Department of Housing and Urban Development (HUD) FIPS ZIPs crosswalk table and GIS software.Footnote 5

Dependent variable: county quarterly join rate

The FHTM data described above was used to create a county quarterly join rate. A join occurs whenever an individual pays the entry fee and signs the distributor agreement. The county-level join rate was created by dividing the count of quarterly FHTM joins in a county by that county’s working-age population (i.e., the number of people 15 to 74 years old) retrieved from the US Census Bureau. The quarterly join rate was then multiplied by 10,000 to reflect joins per 10,000 working-age people in the county. The county quarterly join rate was constructed in this manner to adjust for the county population that is most likely to be recruited and potentially join. The rate is calculated quarterly to provide frequent, repeated measures of joining activity by county residents. If no residents of a particular county joined FHTM in a specific quarter, the join rate for that county in that quarter would be zero. Counties with zero joins over the lifetime of FHTM were included in the analysis with a join rate of zero in every quarter.

Time-varying strain covariate

Covariate variables for this analysis are all measured at the county level. In order to measure financial strain, unemployment risk was created from the monthly unemployment rate for each county from the Bureau of Labor Statistics, using a simple average to convert monthly to quarterly data. Each quarter, a measure of unemployment risk was created by assigning a one to the counties in the top quartile of unemployment rates for a particular quarter. This allows comparison of the riskiest quartile to those counties in the lowest three quartiles of unemployment rate, a common practice in risk factor research (Farrington 2000). With this measure, a county’s risk can change over time. Because unemployment risk is time varying, it will predict pyramid scheme join rate within each trajectory group. We expect that unemployment risk will be associated with an increased join rate within each trajectory group.

Time-stable strain covariate

The second measure of strain, the social vulnerability index (SVI), includes measures of financial strain and other types of strain such as measures of socioeconomics, household composition and disability, minority status and language, and housing and transportation infrastructure. SVI has typically been used to predict community-level vulnerability to natural disasters but has recently been used to predict vulnerability to other events (e.g., COVID-19 impact in Karaye and Horney 2020).Footnote 6 SVI represents percentile rank by census tract, and we use the average percentile rank of census tracts in a county from the Center for Disease Control and Prevention’s 2000 dataset. Because SVI is time stable, this variable will predict trajectory group membership. Informed by differential opportunity theory, we expect that an increase in SVI will make a county more likely to be in any group that has a substantial pyramid scheme join rate.

Opportunity and protection covariates (time-stable)

To be sure time-stable covariates are identified before trajectories begin, we used data from before 2001, when FHTM was founded. We include county-level social capital measures from the year 2000, published and updated by Rupasingha et al. (2006). These variables include rates of bowling centers; civic and social associations; physical fitness facilities; public golf courses; religious organizations; sports clubs; political organizations; professional organizations; business associations; labor organizations; census response rate; voter turnout; and not for profit organizations.Footnote 7 Previous research has used the social capital index constructed in Rupasingha et al. (2006) and similar measures to explain county-level variation in community resilience (Sherrieb et al. 2010), economic development (Malecki 2012), and rural crime (Deller and Deller 2010), as examples. In these cases, there is either a positive or insignificant relationship between levels of social capital and desirable county characteristics. Examining business rather than individual behavior and using the measure created in Rupasingha et al. (2006), Hasan et al. (2017a, 2017b) find that corporate tax avoidance and opportunistic debt contracting is constrained in counties with higher levels of social capital.

We, however, do not have clear predictions on the directionality of potential associations between these social capital variables and county trajectories. As mentioned above, it is possible that social connectedness could serve as either opportunity or protection when considering pyramid scheme victimization because both initial joining decisions and lucrative participation in a pyramid scheme are predicated on recruitment. If the institutions that foster the formation of social capital (e.g., clubs, associations, physical locations where people gather socially, etc.) enhance the likelihood of being recruited and/or the ability to recruit new members, then these institutions may be more specifically classified as “anti-social capital” (Hucklesby 2008; Kay 2020). As described in Rupasingha et al. (2016), we utilize social capital data that has not yet been aggregated, in total or by category, as each social capital dimension may have a positive or negative association (or no relationship) with victimization. There are no issues of collinearity when keeping the social capital variables disaggregated.

Religious affiliation is particularly ambiguous as previous literature suggests that pyramid schemes may rely on religious organizations for recruitment. (Bosley and Knorr 2018; Johnson et al. 2000). To account for a possible relationship, we include adherence rate, defined as the number of religious adherents per county in 2000 over the county’s population (Association of Religion Data Archive 2000).

Other covariates

We included several other covariates to control factors beyond strain and social capital that may affect the county-level pyramid scheme join rate. Two dichotomous variables are included to explore the effect of metropolitan areas on pyramid scheme adoption: metro and metro adjacent. For metro, counties are designated as one if they are in a metro area with populations of 250,000 or greater, and zero otherwise. Metro adjacent counties are designated as one if adjacent to a metro area, regardless of population size or density, and zero otherwise. The metro and metro adjacent variables are constructed from the 2003 Rural–Urban Continuum codes, which uses year 2000 census population data to create categories (United States Department of Agriculture 2020). Population density is defined as population in a county per square mile. This variable controls for different social network structures due to the physical distance between residents. Specifically, the increased distance between residents may increase the cost of recruitment and, therefore, we expect that a county’s population density will be positively related to its pyramid scheme join rate. Military base is a binary measure of counties with active military bases, using data from the US Department of Transportation. While the military base data is from 2021, we manually adjusted for bases that closed while FHTM was still active. Military bases may provide strong affinity groups that will provide opportunity for recruitment or may have a particular population of individuals more susceptible to pyramid schemes (Bond 2021). Kentucky proximity is a binary variable, with a one indicating that a county is either located within Kentucky (where FHTM was founded) or in an adjacent state. Given the way that pyramid schemes move through social networks, we expect that those counties close to the scheme’s origination will be early adopters of the pyramid scheme.

We first present descriptive statistics for county join rate for 2000–2013. Next, we present the model without covariates, followed by results that demonstrate the effect of covariates on group membership and trajectory. Based on the availability and measurement of all included covariates over the time period studied, there are 3,083 counties included in the analysis.

Statistical analysis

This research examines whether strain and opportunity affect the trajectory of pyramid scheme growth within counties across the United States. To address this question, we employ a group-based trajectory model (GBTM): a semiparametric group-based modeling approach used to explore patterns over time (Nagin 1999; 2005; Roeder et al. 1999). Traditionally, within criminology, this model has been used to explore offending patterns over time such as crime trajectories of immigrants (Bersani 2014) or recidivism after incarceration (Cochran and Mears 2017). The model for this paper creates groups of counties that have similar pyramid scheme adoption patterns over time. Using GBTM allows us to focus on place-based characteristics that may foster or inhibit the proliferation of the FHTM pyramid scheme. Rather than investigating individual-level variables that might determine the likelihood of victimization, this modeling approach instead emphasizes the role of contextual factors that could make an area more or less susceptible to the prolific and rapid spread of a pyramid scheme. GBTM estimates continuity or change instead of an exact trajectory. GBTM has been discussed extensively in the literature, therefore, this section will focus on model selection and results (see e.g., Brooks-Russell et al. 2013; Nagin 2005; Nagin and Odgers 2010; Piquero 2008).

Model selection

The models were estimated using Zero Inflated Poisson (ZIP) due to the over representation of zeros in the quarterly county uptake rate. After testing multiple models with up to eight groups and different shape trajectories, the best model was determined to be a four-group model with all cubic trajectories (BIC[3129] = -99,553.18). This selection was based on the Bayes Information Criterion, theory, and probability of the correct model; as expected, the BIC decreased with each additional group, but there was no reason to believe that the additional groups would add to the nuance of the discussion of strain and opportunity and instead, the additional groups would likely lead to an over complexity of the analysis. Nagin (2005) suggests “balancing model parsimony with the objective of reporting the distinctive developmental patterns in the data” (p. 74). See Appendix Table 5 for the BIC for each model with all cubic trajectories up to eight groups.

In addition to comparing BICs across different models, to test the accuracy of the model that had been selected we utilized average posterior probability (AvePP), odds of correct classification (OCC), estimated group probabilities (Pi hat) and the proportion of the sample assigned to the group (P hat), and tight confidence intervals for group membership. AvePP is calculated after the model has been created and measures the probability that each county will be in each trajectory group (Nagin 2005; Roeder et al. 1999). Stata assigns each county to a trajectory group based on which posterior probability is the greatest. This model exceeds the recommended 0.7 (Nagin 2005) with an AvePP for all groups above 0.91. The OCC calculates the odds that each county is assigned to the correct group by relying both on posterior probabilities and the probability of group membership. The OCC should be greater than 5 for all groups (Nagin 2005) and the four-group model is well above 5 for all groups (17.79 is the lowest OCC for all groups). Comparing the estimated group membership to the proportion of the sample assigned to the group reveals that all of the groups have a Pi hat and P hat that are within at least 4/1000 of each other. Finally, the confidence intervals for the four-group model are tight: the 95% confidence intervals range from 0.01 to 0.02 (See Table 1 for all model selection data). The results of the model fit tests demonstrate that the final four group model is a strong fit for the data as supported by Roeder and colleagues (Roeder et al. 1999).

The resulting four-group model suggests that there are distinct trajectories for groups of counties’ quarterly pyramid scheme join rate (RQ1). In the resulting four-group model, we have labeled the groups according to when the peak level of joins in a county happened in relation to the Great Recession (December 2007 through June 2009) (Rich 2013). Based on strain theory, we expect that joins would be higher during a time of economic strain and therefore the group names reflect this hypothesis. The group with little or no activity is low adopter (33.6% of counties are in this group), the group with join rates that peak before the recession is early adopter (11.1%), the group with join rates that have a relatively low peak during the recession is low recession (37.7%), and the group that peaks during the recession and at relatively high join rates is high recession (17.7%). See Fig. 2 for the final model selection. After the final model selection, we reran the selected GBTM with all of the time varying and time stable covariates.

Results

All strain and opportunity covariates were included in the GBTM in order to estimate the covariate parameters simultaneously with the parameters for group trajectory (Nagin 2005). Table 2 has means and ANOVA significance of all the covariates and the dependent variable for the full sample and all groups, and Fig. 3 shows group membership geographically located across the country. The ANOVA significance results suggest that there are statistically significant differences between the trajectory groups for almost all of the covariates. The high recession group had the highest mean level of county quarterly joins. The early adopter group had the highest mean levels of strain: both unemployment risk and SVI. Turning to variables of opportunity or protection, the low adopter group had the highest mean level of several social capital variables: bowling center rates, civic and social association rates, public golf course rates, religious organization rates, business association rates, voter turnout rate, not for profit organization rates, and religious adherence rates. The early adopter group, on the other hand, had the lowest or same mean level of rates of all of the social capital variables except for physical fitness facilities, religious organizations, political organization, and religious adherence when compared to the other trajectory groups. This points to potentially complex processes for social capital variables as suggested by the unique mechanisms of pyramid schemes, working through social networks that may, at times, be protective.

As shown in Fig. 3, trajectory groups tend to be located in geographic clusters. Early adoption of the pyramid scheme is concentrated in a few, fairly well-defined areas covering most of Mississippi as well as significant portions of Arkansas, Missouri, Tennessee, Kentucky (where FHTM was founded), and West Virginia. There are smaller pockets of early adoption along the Indiana-Ohio border, and in South Carolina and Utah. The northeast of the country as well as sections of the northern and middle plains states tended to experience lower join rates throughout the life of the pyramid scheme, falling in the low adopters group. Counties in the high recession group clustered and were buffered by counties in the low recession group. These clusters and their surrounding buffers are widespread across the country but are particularly notable in the upper Midwest, the Southeast, Texas and Oklahoma, and Wyoming and Montana. The following section will discuss statistically significant results for the covariates.

Effect of strain and opportunity on pyramid scheme uptake

This analysis addresses RQ2 and RQ3 by addressing the effect of strain and social capital variables on pyramid scheme adoption and likelihood of group membership.Footnote 8 Results from this analysis – as shown in Tables 3 and 4 – suggest that, in general, strain, as measured by unemployment rate risk and SVI, does increase the rate and timing of pyramid scheme joins, at the county level. Despite the fact that most of the results support strain leading to an increase in adoption, there are more nuanced results discussed below.

For all trajectory groups except the early adopter trajectory, economic strain, measured by unemployment risk, increases pyramid scheme join rates, supporting strain theory (See Table 3 for unemployment risk results). Conversely, economic strain decreases pyramid scheme join rates in the counties in the early adopter trajectory group. This finding of economic strain is particularly enlightening when combined with the SVI findings; an increase in the average percent of the SVI increased the likelihood that a county would belong to the early adopter group compared to the low adopter group (B: 3.20). SVI did not have an effect on the likelihood of belonging to the low recession or high recession group compared to the low adopter group. This may suggest that in counties experiencing the pyramid scheme during the recession, economic strain may be an important contextual factor contributing to victimization.

There are several social capital variables that have consistent effects across all three trajectory groups when compared to the low adopter group. Social capital variables that have protective effects are civic and social association rates, voter turnout, and not for profit rates. These social capital variables are less likely to lead to group membership in any trajectory compared to the low adopter group. Rates of physical fitness facilities, on the other hand, have a consistent opportunity effect; increases in physical fitness facilities rates are associated with a greater likelihood of membership in all trajectory groups compared to the low adopter group.

The remaining statistically significant social capital covariates are protective or opportunity-creating for both the early adopter and low recession group or are opportunity-creating for the high recession group. Counties with a higher bowling center rates are less likely to be in the early adopter or low recession group compared with the low adopter group. The presence of labor organizations tends to be associated with more pyramid scheme activity; counties with higher rates of labor organizations are more likely to be in the early adopter or low recession group compared to the low adopter group. Religious organizations and sports clubs are more numerous in counties where pyramid scheme join rates strongly responded to recession conditions; counties with higher religious organization and sports clubs rates are more likely to be in the high recession group compared with the low adopter group.

The other covariates have mixed effects on group memberships. Starting with metro and metro adjacent, being in a metro area compared to a non-metro area is associated with increased likelihood of group membership in low recession or high recession compared to the low adopter group. Metro adjacent counties are less likely to be in the early adopter group compared to the low adopter and more likely to be in the low recession group, relative to non-metro areas. Increases in population density and military base rate suggest that a county is more likely to be in the low recession group compared to the low adopter group. If a county is in Kentucky or an adjacent state, that county was more likely to be in the early adopter (B: 1.62) group compared to the low adopter group.

Discussion

Given the limited literature on strain and opportunity within white-collar crime victimization and even more limited research on pyramid scheme victimization, this study adds to existing research by providing insight into the trajectory of pyramid scheme victimization and the effect of strain and social capital variables on uptake and trajectory group membership. Theory predicts that strain will increase pyramid scheme victimization and that social capital variables will decrease victimization, but pyramid schemes are unique in that typically protective social capital structures may in fact present opportunities and increase victimization as suggested by Cloward and Ohlin’s (1960) differential opportunity theory. The study finds that strain increases pyramid scheme victimization and that social capital variables have nuanced protection and opportunity effects on pyramid scheme activity.

First, this research did find distinct trajectories of pyramid scheme adoption over time. Next, the results suggest that strain increases county-level pyramid scheme join rates for some trajectory groups, but either had no effect or a mitigating effect for other trajectory groups. The unemployment measure of strain suggests that unemployment may have a more complicated impact on pyramid scheme victimization than originally hypothesized. Our results suggest that the timing of high unemployment rates may matter; it may be that if high unemployment rates occur in a county after the pyramid scheme had already recruited a large share of residents, then unemployment does not increase join rates. This supports the differential opportunity theoretical proposition that strain may not be operating by itself, but instead it may be interacting with other opportunities; in this example, strain may be interacting with the opportunity of potential recruits. The SVI measure of strain suggests that in early adopter counties, it is more than just economic strain that makes a community vulnerable to pyramid scheme proliferation. This finding bolsters the emerging use of SVI for understanding other types of community vulnerability.

Finally, we find that social capital variables act as both opportunity and protection, depending on the variable. This finding is consistent with prior literature that suggests that some social networks and social capital variables may actually aid in spreading pyramid schemes (Bosley and Knorr 2018; Fairfax 2001; Perri and Brody 2012), but also suggest that some of the benefits of social capital variables outweigh the potential for spreading to occur through networks. This research stops short of explaining why different types of social capital have different effects, but instead provides the groundwork for future research to explore the mechanisms by which these social capital variables function with respect to fraud. There is previous literature that suggests that the effect of social capital may vary based on bridging and bonding capital (Beyerlein and Hipp 2005) or rent-seeking and non-rent-seeking groups (Rupasingha et al. 2006) and this research illustrates that there is opportunity to explore types of social capital and their protection or opportunity effect on trajectory group membership.

Before discussing implications of this research, there are several limitations of the data that should be noted. The first limitation is related to the social capital variables. While we were able to use social capital measures from a time period before FHTM’s founding, we are treating these variables as time stable. When comparing the social capital variables over time throughout the time period of the FHTM data, these variables do remain relatively stable but there are some changes over time. It is possible that some of the changes may be affecting pyramid scheme adoption in a way that is not captured by this model. For example, during a time period of extreme recession or depression there may be fewer civic and social organizations because of a reduction of funding. This change in social capital may actually change the subcultural social networks and potential protection for a community. However, this may only change the shape of the trajectory curve and not the cumulative joins in a county. Future research could explore more directly the effect of individual level social capital on individual level pyramid scheme victimization.

Another limitation of this research is the county-level analysis. While we were able to accurately aggregate individual-level joins and find all other data at the county level, pyramid schemes do not abide by county lines. It may be that individuals live close to a county line and their social supports and networks are in a different county.

Also, there are likely some omitted variables that affect pyramid scheme adoption. For example, it appears that there may be geographic influences occurring other than Kentucky proximity. Once a pyramid scheme jumps from one nonadjacent county to another (perhaps through a personal connection), it appears that it may spread through the surrounding counties (as shown in Fig. 1). In addition to geography, other variables may be omitted. For example, previous literature suggests that the type of religion may influence whether social capital has a protective or opportunity effect (Beyerlein and Hipp 2005).Footnote 9

Finally, it could be that FHTM functioned in a unique way compared to other pyramid schemes. While there is nothing to suggest that the trajectories and effects of social capital would be different for other pyramid schemes, it is important to compare the results of this research to other pyramid scheme trajectories and the effect of strain and social capital on those trajectories.

Even with these limitations, this study is a good first step to explore trends in pyramid scheme joins over time and different variables that may lead to this activity. Therefore, this research has several implications revolving around education, intervention and future research. The trajectories we find suggest that there may be a point when a county has a certain level of victimization that moves a county out of the low adopter group and into one of the other three groups. Future research should explore if there is a tipping point in a county—at what point does a pyramid scheme really take hold? Determining whether there is a tipping point may direct regulators to begin investigations at a certain level of complaints. This is particularly important as pyramid scheme victims are often hesitant to report involvement due to many factors, including embarrassment and guilt (Austin 2004; Fairfax 2001; Perri and Brody 2012). This silence may require regulators to begin investigations at a lower level of complaints compared to other types of financial fraud. Future research can use these trajectories to further explore the level of complaints that might signal a change from a low adopter county to a different, higher level of activity, trajectory.

The opportunity variables suggest that there may be particular ways to target consumer education. The positive association between adoption and the county’s physical fitness facilities and labor organizations suggests that targeting education at these locations and organizations may help to reduce join rates. The strain findings also suggest targeting education; communities with a high SVI have an increased likelihood of following the early adopter trajectory compared to the low adopter trajectory and may benefit from targeted education. The strain findings also suggest that regulators may need to be on heightened alert during economic downturns.

In addition to the policy implications that arise directly from this research, future research can explore other areas for additional policy implications. In the case of pyramid schemes, subcultures play a unique and dual role: the subculture of affinity networks that allows for greater recruitment and the subculture of the pyramid scheme that may be related to initial participation and continued involvement. Future research can attempt to tease out which subculture has a greater influence on potential recruits in order to interrupt the recruitment chain through targeted education. This area of future research is related to the line of research that could explore individual level recruitment within a pyramid scheme. When exploring individual level recruitment, other theories may be useful to explain pyramid scheme spread like differential association theory or other learning theories. This research did not explore individual level recruitment due to limitations with the data and a focus on county level risk, but future research could try to explore a network analysis of who is recruiting whom and how that recruitment process works.

Finally, this research highlights the importance of access to pyramid scheme data for future research. New methods and disciplinary perspectives would add to the existing consumer protection research, but would require appropriate data that is not generally publicly available. For example, as mentioned above, to conduct an individual-level network analysis to further examine scheme diffusion over time. Case data with recruiting link information (i.e., who recruited who) would help determine whether there are particular nodes around which recruitment centers. Case data would allow researchers to test the external validity of these findings, expand on our methods and approaches, and bypass measurement issues that plague other methodological approaches (e.g., survey or complaint data analysis) to explore patterns in fraud victimization.

Notes

In this FTC survey (Anderson 2019), a consumer is considered to have joined a pyramid scheme if they “purchased an opportunity to start or operate a business where they were led to expect that most of the money they earned would come from recruiting others to participate in the business rather than from the sale of products” (16). The survey estimated that there were 800,000 victims who joined a pyramid scheme in 2017, and about half of those people (400,000) earned less than half of the amount the promoter promised would be earned. It can be difficult to distinguish between business opportunity fraud and pyramid scheme fraud, so the FTC Fraud Survey data may understate the number of pyramid scheme victims in any given year as it reports business opportunity fraud as a separate category. The Consumer Sentinel Network Data Book reports now classify pyramid scheme fraud as a subtype of business opportunity fraud (Federal Trade Commission 2022). In the 2017 survey, the FTC found that fraudulent business opportunities had the highest median loss of all fraud types with a median amount paid of $650 (Anderson 2019).

For an example of a criminal prosecution in a pyramid scheme case, see the U.S. v. Burks (2016).

Other examples of the application of the Koscot test in federal civil cases include U.S. v. Gold Unlimited Inc. (1999), FTC v. BurnLounge Inc. (2014) and FTC v. Vemma Nutrition (2016). For example, in U.S. v. Gold Unlimited, the court articulated the two prongs of the Koscot test by defining a pyramid scheme as: “any plan, program, device, scheme, or other process characterized by the payment by participants of money to the company in return for which they receive the right to sell a product and the right to receive in return for recruiting other participants into the program rewards which are unrelated to the sale of the product to ultimate users.”.

Both pyramid and Ponzi schemes siphon money from the majority of participants to fund rewards for founders and a minority of participants. Unlike Ponzis, pyramid schemes provide explicit rewards for recruiting new participants (Lewis 2015). For a more complete discussion of the difference between pyramid and Ponzi schemes see Nolasco et al. (2013).

Federal Information Processing Standards (FIPS) codes are assigned to geographic areas of varying levels of granularity, from census blocks to states. In order to ensure accuracy of the 2010 data, we compared the 2010 HUD with a 2000 Centers for Disease Control FIPS ZIPs crosswalk table and found no substantial change over time.

For a full description of the SVI, see Flanagan et al. (2011).

For a full description of these variables see Rupasingha et al. (2006).

For all comparisons discussed in text, the low adopter group was used as the reference category. For this paper, the question of high join rates compared to consistently low and/or zero join rates was the most salient result to present. That being said, GBTM allows for interpretation of nuance about the timing and magnitude of the trajectory of adoption. Some of the most theoretically relevant findings from comparisons with other reference categories are that as the SVI increases (as strain increases), the likelihood of being in the early adopter trajectory is greater than being in all other groups. This suggests that levels of high strain may lead to early adoption of pyramid schemes, regardless of opportunity and protection. Throughout all the results, voter turnout and not for profit organizations also appear to protect from pyramid scheme adoption (either early adoption or high recession). In contrast, fitness centers appear to consistently be associated with earlier adoption, perhaps showing evidence that this particular pyramid scheme moved through the subcultural network at fitness centers. Full results of all reference groups available upon request.

Specifically, Beyelein and Hipp (2005) find that some religious denominations focus on bonding capital, where bonding capital may increase opportunity for pyramid scheme activity partially through internal trust and silence, while other denominations focus on bridging capital which might serve to lessen community-level strain.

References

Anderson, K.B. (2019). Mass-Market Consumer Fraud in the United States: A 2017 Update. Federal Trade Commission. Retrieved from -https://www.ftc.gov/system/files/documents/reports/mass-market-consumer-fraud-united-states-2017-update/p105502massmarketconsumerfraud2017report.pdf. Accessed 6 Sep 2022

Association of Religion Data Archive. (2000). Religious Congregations and Membership Study. ARDA

Austin, D. E. (2004). In god we trust: the cultural and social impact of affinity fraud in the African American church. U. Md. LJ Race, Religion, Gender and Class, 4, 365

Bersani, B. E. (2014). An examination of first and second generation immigrant offending trajectories. Justice Quarterly, 31(2), 315–343

Better Business Bureau. (2021). BBB Scam Alert: Social media gift exchange is an illegal pyramid scheme. Retrieved at https://www.bbb.org/article/news-releases/18854-bbb-warning-secret-sister-gift-exchange-is-illegal. Accesses 6 Sep 2022

Beyerlein, K., & Hipp, J. R. (2005). Social capital, too much of a good thing? American religious traditions and community crime. Social Forces, 84(2), 995–1013

Bond, C. (2021). MLMs are a nightmare for women and everyone they know. HuffPost UK. https://www.huffpost.com/entry/mlm-pyramid-scheme-target-women-financial-freedom_l_5d0bfd60e4b07ae90d9a6a9e. Accessed 6 Sep 2022

Bosley, S. A., Bellemare, M. F., Umwali, L., & York, J. (2019). Decision-making and vulnerability in a pyramid scheme fraud. Journal of Behavioral and Experimental Economics, 80, 1–13

Bosley, S., & Knorr, M. (2018). Pyramids, Ponzis and fraud prevention: Lessons from a case study. Journal of Financial Crime, 25(1), 81–94.

Brooks-Russell, A., Foshee, V. A., & Ennett, S. T. (2013). Predictors of latent trajectory classes of physical dating violence victimization. Journal of Youth and Adolescence, 42(4), 566–580

Button, M., Lewis, C., and Tapley, J. (2009). Fraud typologies and the victims of fraud: Literature review. National Fraud Authority. Office of Fair Trading: University of Portsmouth. Available Online: https://pure.port.ac.uk/ws/portalfiles/portal/1926122/NFA_report3_16.12.09.pdf. Accessed 6 Sep 2022

Cass, A. I. (2007). Routine activities and sexual assault: An analysis of individual-and school-level factors. Violence and Victims, 22(3), 350–366

Cloward, R. A., & Ohlin, L. E. (1960). Delinquency and opportunity: A study of delinquent gangs. Routledge

Cochran, J. C., & Mears, D. P. (2017). The path of least desistance: Inmate compliance and recidivism. Justice Quarterly, 34(3), 431–458

Cohen, M. A. (2016). The costs of white-collar crime. In S. Van Slyke, M. L. Benson, & F. T. Cullen (Eds.), Oxford Handbook of White-collar Crime (pp. 78–98). Oxford University Press.

Croall, H. (2016). What is known and what should be known about white-collar crime victimization? In S. Van Slyke, M. L. Benson, & F. T. Cullen (Eds.), Oxford Handbook of White-collar Crime (pp. 59–77). Oxford University Press.

Cullen, F. T., & Messner, S. F. (2007). The making of criminology revisited: An oral history of Merton’s anomie paradigm. Theoretical Criminology, 11(1), 5–37

Curry, T. R., & Zavala, E. (2020). A multi-theoretical perspective on cyber dating abuse victimization and perpetration within intimate relationships: A test of general strain, social learning, and self-control theories. Victims and Offenders, 15(4), 499–519

Deller, S. C., & Deller, M. A. (2010). Rural Crime and Social Capital. Growth and Change, 41(2), 221–275

Fair. (2020, December 14). Operation income illusion cracks down on illusory income claims. Federal Trade Commission. https://www.ftc.gov/news-events/blogs/business-blog/2020/12/operation-income-illusion-cracks-down-illusory-income-claims. Accessed 6 Sep 2020

Fairfax, L. M. (2001). With friends like these…: Toward a more efficacious response to affinity-based securities and investment fraud. Georgia Law Review, 36, 63

Farrington, D. P. (2000). Explaining and preventing crime: The globalization of knowledge—The American Society of Criminology 1999 Presidential Address. Criminology, 38(1), 1–24

Federal Trade Commission. (2013, January 28). FTC action leads court to halt alleged pyramid scheme [Press Release]. Retrieved at https://www.ftc.gov/news-events/news/press-releases/2013/01/ftc-action-leads-court-halt-alleged-pyramid-scheme. Accessed 6 Sep 2022

Federal Trade Commission. (2014). FTC settlement bans pyramid scheme operations from multi-level marketing. Retrieved from https://www.ftc.gov/news-events/press-releases/2014/05/ftc-settlement-bans-pyramid-scheme-operators-multi-level. Accessed 6 Sep 2022

Federal Trade Commission. (2016, November 8). FTC returns more than $3.7 million to people harmed by pyramid scheme. Federal Trade Commission. https://www.ftc.gov/news-events/press-releases/2016/11/ftc-returns-more-37-million-people-harmed-pyramid-scheme. Accessed 6 Sep 2022

Federal Trade Commission. (2022). Consumer Sentinel Network Data Book 2021. Retrieved from https://www.ftc.gov/system/files/ftc_gov/pdf/CSN%20Annual%20Data%20Book%202021%20Final%20PDF.pdf. Accessed 6 Sep 2022

Federal Trade Commission v. BurnLounge, Inc., Civil Action No. 207-cv-03654-GW-FMO (C.D. Ca. June 2, 2014)

Federal Trade Commission v. Koscot Interplanetary, Inc. (86 F.T.C. 1106, 1181, 1975)

Federal Trade Commission v. Vemma Nutrition, Civil Action No. CV-15–01578-PHX-JJT (F.D. Az. Dec. 21, 2016)

Fisher, B. S., Daigle, L. E., & Cullen, F. T. (2009). Unsafe in the Ivory Tower: The Sexual Victimization of College Women. Sage Publications

Flanagan, B. E., Gregory, E. W., Hallisey, E. J., Heitgerd, J. L., & Lewis, B. (2011). A social vulnerability index for disaster management. Journal of Homeland Security and Emergency Management, 8(1), 1–22.

Fox, K. A., Nobles, M. R., & Akers, R. L. (2011). Is stalking a learned phenomenon? An empirical test of social learning theory. Journal of Criminal Justice, 39(1), 39–47

Frankel, T. (2012). The Ponzi Scheme Puzzle: A History and Analysis of Con Artists and Victims. Oxford University Press

Ganzini, L., McFarland, B., & Bloom, J. (1990). Victims of fraud: Comparing victims of white collar and violent crime. Journal of the American Academy of Psychiatry and the Law Online, 18(1), 55–63

Gastwirth, J. L. (1977). A probability model of a pyramid scheme. The American Statistician, 31(2), 79–82

Gottfredson, D. C., & DiPietro, S. M. (2011). School size, social capital, and student victimization. Sociology of Education, 84(1), 69–89

Gressin, S. (2020). This “Game” is a chain letter scam. Federal Trade Commission. https://www.consumer.ftc.gov/blog/2020/05/game-chain-letter-scam. Accessed 6 Sep 2022

Gunn G. (2015). Broken people, deep scars, fractured communities, fear and distrust: Affinity fraud and the church of Jesus Christ of latter-day Saints. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2562462. Accessed 6 Sep 2022

Hasan, I., Hoi, C. K., Wu, Q., & Zhang, H. (2017a). Does Social Capital Matter in Corporate Decisions? Evidence from Corporate Tax Avoidance. Journal of Accounting Research, 55(3), 629–668

Hasan, I., Hoi, C. K., Wu, Q., & Zhang, H. (2017b). Social Capital and Debt Contracting: Evidence from Bank Loans and Public Bonds. Journal of Financial and Quantitative Analysis, 52(3), 1017–1047

Holtfreter, K., Reisig, M. D., & Pratt, T. C. (2008). Low self-control, routine activities, and fraud victimization. Criminology, 46(1), 189–220

Hucklesby, A. (2008). Vehicles of desistance? The impact of electronically monitored curfew orders. Criminology and Criminal Justice, 8(1), 51–71

Johnson, B. R., Jang, S. J., De Li, S., & Larson, D. (2000). The ‘invisible institution’ and Black youth crime: The church as an agency of local social control. Journal of Youth and Adolescence, 29(4), 479–498

Karaye, I. M., & Horney, J. A. (2020). The impact of social vulnerability on COVID-19 in the US: An analysis of spatially varying relationships. American Journal of Preventive Medicine, 59(3), 317–325

Kay, C. (2020). Rethinking social capital in the desistance process: The ‘Artful Dodger’ complex. European Journal of Criminology, 19(5), 1243–1259.

Keep, W. W., & Vander Nat, P. J. (2014). Multilevel marketing and pyramid schemes in the United States. Journal of Historical Research in Marketing, 6(4), 1–27.

Langton, L., & Piquero, N. L. (2007). Can general strain theory explain white-collar crime? A preliminary investigation of the relationship between strain and select white-collar offenses. Journal of Criminal Justice, 35(1), 1–15

Lewis, M. K. (2015). Understanding Ponzi Schemes. Edward Elgar Publishing

Malecki, E. J. (2012). Regional Social Capital: Why it Matters. Regional Studies, 46(8), 1023–1039

McCarthy, B., Hagan, J., & Martin, M. J. (2002). In and out of harm’s way: Violent victimization and the social capital of fictive street families. Criminology, 40(4), 831–866

Messner, S. F., & Rosenfeld, R. (1994). Crime and the American dream. Wadsworth

Nagin, D. S. (1999). Analyzing developmental trajectories: A semiparametric, group-based approach. Psychological Methods, 4(2), 139

Nagin, D. S. (2005). Group-Based Modeling of Development. Harvard University Press

Nagin, D. S., & Odgers, C. L. (2010). Group-based trajectory modeling in clinical research. Annual Review of Clinical Psychology, 6, 109–138

Nash, R., Bouchard, M., & Malm, A. (2018). Twisting trust: Social networks, due diligence, and loss of capital in a Ponzi scheme. Crime, Law and Social Change, 69(1), 67–89

Nolasco, C. A. R., Vaughn, M. S., & Del Carmen, R. V. (2013). Revisiting the choice model of Ponzi and Pyramid schemes: Analysis of case law. Crime, Law and Social Change, 60(4), 375–400

O’Donnell, J. (2010). Fortune hi-tech: American dream or pyramid scheme? USA Today. http://usatoday30.usatoday.com/money/companies/2010-10-15-multilevelmarketing14_CV_N.htm. Accessed 6 Sep 2022

Perri, F. S., & Brody, R. G. (2012). The optics of fraud: Affiliations that enhance offender credibility. Journal of Financial Crime, 19, 305–320.

Piquero, A. R. (2008). Taking stock of developmental trajectories of criminal activity over the life course. In the Long View of Crime: A Synthesis of Longitudinal Research (pp. 23–78). Springer

Policastro, C., & Payne, B. K. (2015). Can you hear me now? Telemarketing fraud victimization and lifestyles. American Journal of Criminal Justice, 40(3), 620–638

Pratt, T. C., Turanovic, J. J., Fox, K. A., & Wright, K. A. (2014). Self-control and victimization: A meta-analysis. Criminology, 52(1), 87–116

Putnam, R. (1993). The prosperous community: Social capital and public life. The american prospect 13(Spring) (vol. 4). Available online: http://www.prospect.org/print/vol/13. Accessed 6 Sep 2022

Rich, R. (2013). The great recession. Federal Reserve History. https://www.federalreservehistory.org/essays/great-recession-of-200709. Accessed 6 Sep 2022

Roeder, K., Lynch, K. G., & Nagin, D. S. (1999). Modeling uncertainty in latent class membership: A case study in criminology. Journal of the American Statistical Association, 94, 766–776

Rupasingha, A., Goetz, S. J., & Freshwater, D. (2006). The production of social capital in US counties. Journal of Socio-Economics, 35, 83–101

Sacchetti, M., & Healy, B. (2014). Fervor for TelexFree swayed thousands. Boston Globe. https://www.bostonglobe.com/business/2014/06/12/alleged-victims-tell-their-stories-telexfree-rapid-growth-becomes-easier-understand/sUrFj4D5jghbs8dumwYl3K/story.html. Accessed 6 Sep 2022

Schoepfer, A., & Piquero, N. L. (2006). Exploring white-collar crime and the American dream: A partial test of institutional anomie theory. Journal of Criminal Justice, 34(3), 227–235

Schreck, C. J. (1999). Criminal victimization and low self-control: An extension and test of a general theory of crime. Justice Quarterly, 16(3), 633–654

Sherrieb, K., Norris, F. H., & Galea, S. (2010). Measuring Capacities for Community Resilience. Social Indicators Research, 99, 227–247

Shichor, D., Sechrest, D. K., & Doocy, J. (2000). Victims of Investment Fraud. Contemporary Issues in Crime and Criminal Justice: Essays in Honor of Gilbert Geis (pp. 81–96). Prentice Hall

Shover, N., Coffey, G. S., & Sanders, C. R. (2004). Dialing for dollars: Opportunities, justifications, and telemarketing fraud. Qualitative Sociology, 27(1), 59–75

Shover, N., Fox, G. L., & Mills, M. (1994). Long-term consequences of victimization by white-collar crime. Justice Quarterly, 11(1), 75–98

Simpson, S. S., & Weisburd, D. (Eds.). (2009). The Criminology of White-collar Crime (Vol. 228). Springer

Spalek, B. (2007). Knowledgeable consumers. London: Harm and society foundation. Available online at https://www.crimeandjustice.org.uk/sites/crimeandjustice.org.uk/files/Consumers_Final_version_200807.pdf. Accessed 6 Sep 2022

Stewart, E. A., Elifson, K. W., & Sterk, C. E. (2004). Integrating the general theory of crime into an explanation of violent victimization among female offenders. Justice Quarterly, 21(1), 159–181

Titus, R. M., & Gover, A. R. (2001). Personal fraud: The victims and the scams. Crime Prevention Studies, 12, 133–152

Torres v. SGE Management, LLC, 838 F.3d 629 (5th Cir. 2016)

Trahan, A., Marquart, J. W., & Mullings, J. (2005). Fraud and the American dream: Toward an understanding of fraud victimization. Deviant Behavior, 26(6), 601–620

United States Department of Agriculture. (2020, December 10). Documentation. USDA ERS - Documentation. https://www.ers.usda.gov/data-products/rural-urban-continuum-codes/documentation/#Scope. Accessed 6 Sep 2022

US v. Gold Unlimited, Inc., 177 F.3d 472 (6th Cir. 1999).

United States v. Paul Burks (2016), Case No: 3:14-cr-208-MOC-1 (W.D.N.C. Oct. 2014)

Vander Nat, P. J., & Keep, W. W. (2002). Marketing fraud: An approach for differentiating multilevel marketing from pyramid schemes. Journal of Public Policy and Marketing, 21(1), 139–151

Walters, G. D. (2020). Unraveling the bidirectional relationship between bullying victimization and perpetration: A test of mechanisms from opportunity and general strain theories. Youth Violence and Juvenile Justice, 18(4), 395–411

Wang, X., & Holtfreter, K. (2012). The effects of corporation-and industry-level strain and opportunity on corporate crime. Journal of Research in Crime and Delinquency, 49(2), 151–185

Weisburd, D., Waring, E., & Chayet, E. F. (2001). White-collar Crime and Criminal Careers. Cambridge University Press

Acknowledgements

We would like to thank Thomas A. Loughran for his consultation and comments on an earlier draft of this paper, David O-Toole for his insights regarding Fortune Hi-Tech Marketing, and the reviewers for their helpful suggestions.

Author information

Authors and Affiliations

Ethics declarations

Conflict Interests

Stacie Bosley has served as an expert witness in cases related to multi-level marketing and pyramid scheme fraud, both for federal and state government agencies and private law firms, and she continues to be engaged in this consulting work.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions